how are rsus taxed in india

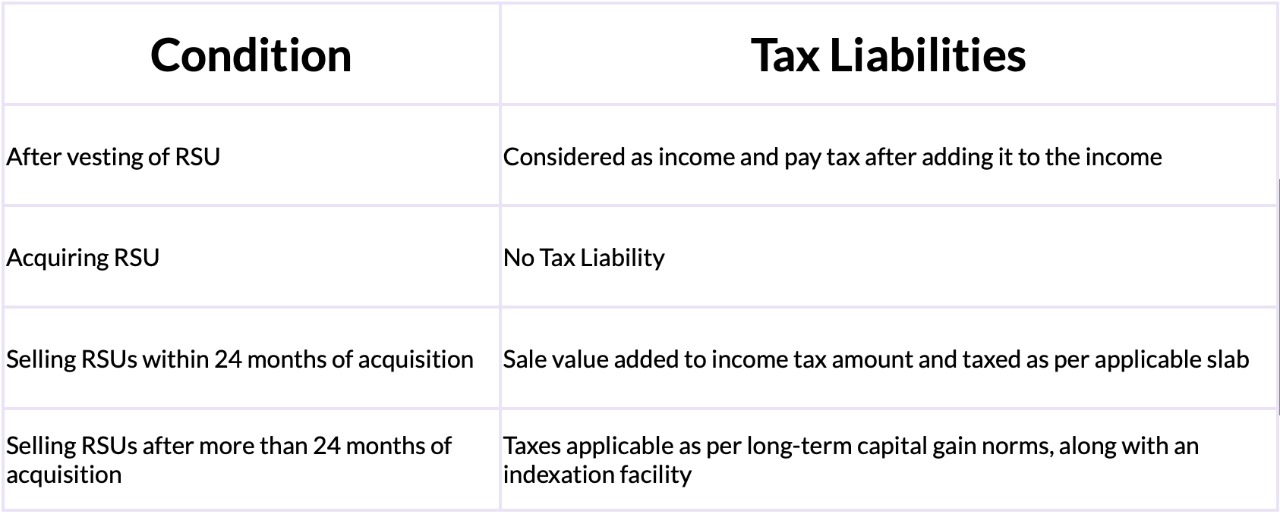

Web RSUs are taxed as income at vesting. Web The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Web When you receive RSUs as part of your compensation they are taxed as ordinary income.

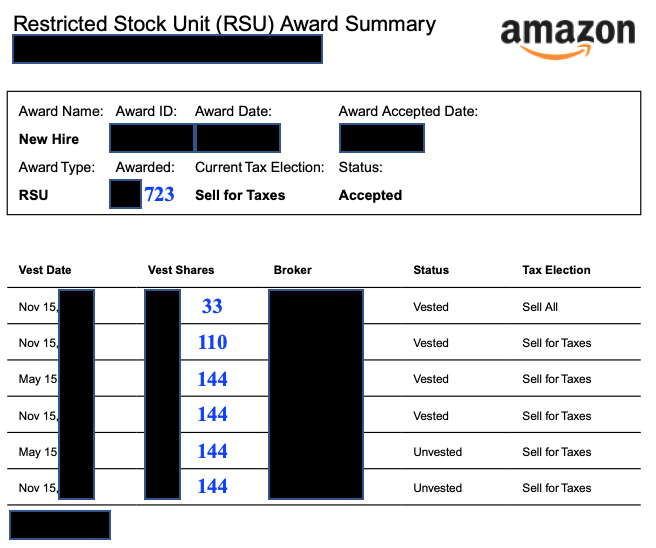

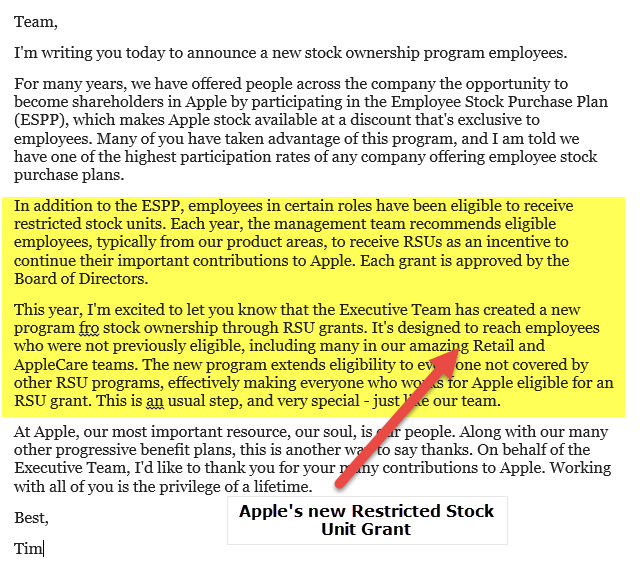

. Web What is a Restricted Stock Unit. Capital Gains Tax. Shares typically vest in tranches over a period of timefour years is common.

Web RSUs or Restricted Stock Units as the name suggests are both restricted and stocks which simply means these come as stocks but with certain restrictions these. RSUs or Restricted Stock Units work a little differently than traditional restricted stock. Your taxable income is the market value of the shares at vesting.

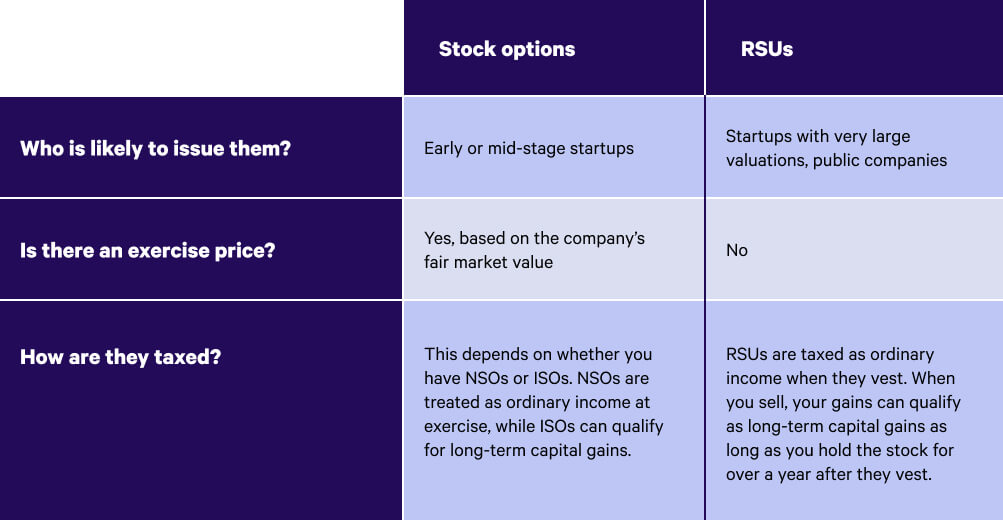

Web The taxation of RSUs is a bit simpler than for standard restricted stock plans. Web The rules that govern the taxation of ESPP ESOP and RSUs are the same as they all deal with stocks that an employee receives and the taxation rules are also fairly easy to. Restricted Stock Units RSUs have become a.

Web RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. RSUs are taxed at the ordinary income rate when issued typically after a vesting schedule. Web RSUs are taxable in two instances in India.

Web Restricted stock units or RSUs are one of the most popular ways for a business to incentivise performance. Web With RSUs you are taxed when the shares are delivered which is almost always at vesting. Restricted stock is technically a gift of stock.

Web With RSUs you are taxed when the shares are delivered which is almost always at vesting. Certificate or statement specifying the nature of income and the amount of tax deducted therefrom or paid by the. Ordinary Income Tax.

Web With RSUs you are taxed when the shares are delivered which is almost always at vesting. Your taxable income is the market value of the shares at vesting. Web foreign tax deducted or paid on such income in Form No.

Web In summary. Instead of receiving the 100 shares of stock you would receive 78 shares of stock. Your taxable income is the market value of the shares at vesting.

Web Foreign RSUstock tax calculator. What are Restricted Stock Units RSU. Because there is no actual stock issued at grant no Section 83 b election is permitted.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. Web Carol Nachbaur April 29 2022. When shares are allotted to the employee after he has exercised the option on completion of the vesting period.

Demystifying Your Amazon Rsus Resilient Asset Management

Income Tax Implications On Rsus Or Espps

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Rsus Vs Stock Options What S The Difference Wealthfront

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Investing In Us Foreign Stocks Know How Buying Selling These Scrips Are Taxed In India The Economic Times

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist

Restricted Stock Units Definition Examples How It Works

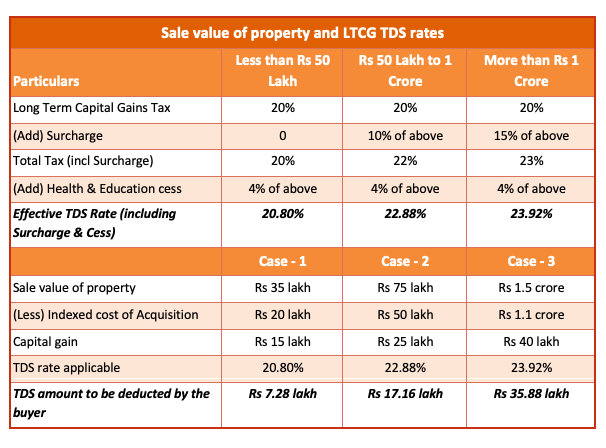

Nri S Complete Guide To Taxes While Selling Property In India Scripbox

Rsu Vs Rsa What S The Difference District Capital Management

Income Tax Implications On Rsus Or Espps

Employees Compensation Types Rsu Vs Esop Vs Sar

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsus Can Make For A Shocking Tax Bill Without Proper Planning Summitry

Rsu Of Mnc Perquisite Tax Capital Gains Itr

A Guide To Restricted Stock Units Rsus And Divorce

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana